📊 Have you ever found yourself scrambling to provide proof of income or struggling to manage your employees' payroll? In today's fast-paced business world, professional bank statement maker software LEARN MORE is becoming an essential tool for both individuals and companies. But what exactly is it, and why should you care?

Imagine a world where creating pay stubs, managing payroll, and generating financial documents is as easy as a few clicks. 🖱️ That’s the power of a professional bank statement maker. Whether you’re an employee needing to prove your income for a loan application, or a small business owner trying to streamline your payroll process, this software could be the game-changer you’ve been looking for.

In this comprehensive guide, we’ll dive deep into the world of pay stubs and bank statement makers. We’ll explore everything from the basics of what a pay stub is, to the benefits of using electronic pay stubs for your business. We’ll even touch on the risks of fake pay stubs and how to spot them. So, buckle up and get ready to discover how this innovative tool can revolutionize your financial documentation process! 💼💡

What is a pay stub?

What is a pay stub?

A pay stub, also known as a paycheck stub or wage statement, is a crucial document that provides a detailed breakdown of an employee’s earnings and deductions for a specific pay period. It serves as a record of compensation and helps both employers and employees keep track of financial transactions related to work.

Key Components of a Pay Stub

A typical pay stub includes the following information:

-

Employee details

-

Employer information

-

Pay period dates

-

Gross earnings

-

Deductions

-

Net pay

Let’s explore these components in more detail:

| Component | Description |

|---|---|

| Employee details | Name, address, Social Security number (last 4 digits) |

| Employer information | Company name, address, and tax ID number |

| Pay period dates | Start and end dates of the current pay period |

| Gross earnings | Total amount earned before deductions |

| Deductions | Taxes, insurance premiums, retirement contributions, etc. |

| Net pay | Final amount received after all deductions |

Importance of Pay Stubs

Pay stubs serve several important purposes:

-

Provide transparency in the payroll process

-

Help employees verify their earnings and deductions

-

Serve as proof of income for loans, rentals, or government benefits

-

Assist in resolving payroll disputes

-

Aid in tax preparation and filing

Understanding your pay stub is essential for managing your finances and ensuring accurate compensation. Now that we’ve covered what a pay stub is, let’s explore whether bank statement maker software can be used for business purposes.

Can I use a bank statement maker software for business purposes?

Can I use a bank statement maker software for business purposes?

Yes, you can use bank statement maker software for business purposes, but it’s important to proceed with caution. While these tools can help generate professional-looking statements, they should only be used for legitimate reasons, such as creating financial projections or organizing records. It’s crucial to ensure compliance with legal and ethical standards when using such software for business-related activities.

How Does Our Check Stub Maker Work?

How to Use Our Check Stub Maker

Our check stub maker is designed to be user-friendly and efficient. Here’s a step-by-step guide on how to use it:

-

Enter Employee Information

-

Input Wage and Hour Details

-

Add Deductions and Contributions

-

Review and Customize

-

Generate and Download

Step-by-Step Process

-

Enter Employee Information

-

Fill in basic details like name, address, and employee ID

-

Add company information including name and address

-

-

Input Wage and Hour Details

-

Enter hourly rate or salary

-

Specify pay period and hours worked

-

-

Add Deductions and Contributions

-

Include taxes, insurance, and other withholdings

-

Add any employer contributions

-

-

Review and Customize

-

Double-check all entered information

-

Customize the layout and design if desired

-

-

Generate and Download

-

Click ‘Generate’ to create the pay stub

-

Download in your preferred format (PDF, Excel, etc.)

-

Comparison of Features

| Feature | Basic Plan | Premium Plan |

|---|---|---|

| Custom Logo | ✓ | ✓ |

| Multiple Formats | ✗ | ✓ |

| Bulk Generation | ✗ | ✓ |

| Cloud Storage | ✗ | ✓ |

| 24/7 Support | ✓ | ✓ |

Our check stub maker streamlines the process of creating accurate and professional pay stubs. By following these simple steps, you can generate pay stubs quickly and efficiently, saving time and reducing errors. The user-friendly interface ensures that even those with minimal payroll experience can create high-quality pay stubs with ease.

Why choose our Paystub Generator?

Why choose our Paystub Generator?

User-Friendly Interface

Our paystub generator offers an intuitive and easy-to-navigate interface, making it accessible for users of all technical levels. You can create professional-looking pay stubs in just a few minutes, saving time and effort.

Customization Options

We provide a wide range of customization features to ensure your pay stubs meet your specific needs:

-

Multiple templates to choose from

-

Ability to add company logo

-

Customizable fields for various deductions and earnings

Accuracy and Compliance

Our software is regularly updated to comply with the latest tax regulations and labor laws, ensuring your pay stubs are always accurate and legally compliant.

| Feature | Benefit |

|---|---|

| Auto-calculations | Eliminates manual errors |

| Tax updates | Ensures compliance with current laws |

| Data validation | Prevents incorrect information input |

Secure and Confidential

We prioritize the security of your sensitive financial information:

-

256-bit SSL encryption

-

Secure cloud storage

-

No data retention after stub generation

Cost-Effective Solution

Our paystub generator offers a cost-effective alternative to expensive payroll software or outsourcing services, making it an ideal choice for small to medium-sized businesses and independent contractors.

24/7 Availability and Support

Generate pay stubs anytime, anywhere with our cloud-based solution. Our dedicated customer support team is available round the clock to assist you with any queries or issues.

We’ve Helped Customers Create Their Pay Stubs Form Using Our Generator

Customer Success Stories

Our pay stub generator has helped countless customers create accurate and professional pay stubs. Here are some examples of how our software has benefited various users:

Small Business Owners

-

Streamlined payroll process

-

Saved time and resources

-

Improved employee satisfaction

Freelancers and Independent Contractors

-

Easily generated proof of income

-

Simplified tax filing

-

Enhanced professional image

Human Resources Departments

-

Reduced errors in payroll documentation

-

Increased efficiency in record-keeping

-

Improved compliance with labor laws

Here’s a breakdown of our customer satisfaction rates:

| Customer Type | Satisfaction Rate | Time Saved (per pay period) |

|---|---|---|

| Small Business | 95% | 2-3 hours |

| Freelancers | 98% | 1-2 hours |

| HR Departments | 92% | 4-5 hours |

Our users appreciate the user-friendly interface and customizable templates that allow them to create pay stubs tailored to their specific needs. Many have reported that our generator has simplified their financial documentation processes, making it easier to secure loans, apartments, and other services requiring proof of income.

By providing a reliable and efficient solution for pay stub creation, we’ve empowered our customers to focus on growing their businesses and managing their finances with confidence. The positive feedback we’ve received demonstrates the value and impact of our pay stub generator across various industries and user types.

Benefits

Streamlined Payroll Processing

Using a professional bank statement maker software offers numerous benefits for businesses of all sizes. One of the primary advantages is the streamlined payroll processing it provides. With automated calculations and formatting, payroll tasks that once took hours can now be completed in minutes.

-

Reduced errors

-

Time savings

-

Improved accuracy

-

Consistency across statements

Cost-Effective Solution

Implementing a bank statement maker software is a cost-effective solution for businesses looking to optimize their financial processes.

| Traditional Method | Bank Statement Maker Software |

|---|---|

| High labor costs | Reduced manual work |

| Potential errors | Automated accuracy |

| Time-consuming | Quick turnaround |

| Paper-based | Environmentally friendly |

Enhanced Security and Compliance

In today’s digital age, security and compliance are paramount. A professional bank statement maker software offers enhanced security features and ensures compliance with relevant regulations.

-

Encrypted data storage

-

Secure access controls

-

Automatic updates for regulatory changes

-

Audit trails for all transactions

Improved Employee Experience

By utilizing a bank statement maker software, businesses can significantly improve the employee experience. Employees can easily access their financial information, leading to increased satisfaction and reduced HR inquiries.

Now that we’ve explored the benefits of using a professional bank statement maker software, let’s examine how it actually works in practice.

What is an Employee Pay Stub?

What is an Employee Pay Stub?

An employee pay stub, also known as a paycheck stub or wage statement, is a crucial document that provides a detailed breakdown of an employee’s earnings and deductions for a specific pay period. It serves as a transparent record of compensation and helps both employers and employees maintain accurate financial records.

Key Components of a Pay Stub

A typical pay stub includes the following essential information:

-

Employee Details

-

Full name

-

Employee ID number

-

Social Security number (often partially masked)

-

-

Employer Information

-

Company name

-

Address

-

Contact details

-

-

Pay Period Information

-

Start and end dates of the pay period

-

Pay date

-

-

Earnings

-

Gross pay

-

Regular hours worked

-

Overtime hours (if applicable)

-

Hourly rate or salary

-

-

Deductions

-

Federal income tax

-

State and local taxes

-

Social Security and Medicare contributions

-

Health insurance premiums

-

Retirement plan contributions

-

-

Net Pay

-

Total amount after all deductions

-

Importance of Pay Stubs

Pay stubs serve several important purposes:

| Purpose | Description |

|---|---|

| Financial Record | Provides a detailed history of earnings and deductions |

| Tax Filing | Assists in preparing accurate tax returns |

| Loan Applications | Serves as proof of income for lenders |

| Dispute Resolution | Helps resolve payroll discrepancies |

| Budgeting | Enables employees to track their income and plan finances |

Understanding the components of a pay stub is essential for both employers and employees to ensure accurate compensation and maintain financial transparency in the workplace.

Who Needs A Pay Stub?

Who Needs A Pay Stub?

A. Employees:

Employees are the primary beneficiaries of pay stubs. These documents serve as crucial records of their earnings, deductions, and overall financial situation. Pay stubs are essential for:

-

Verifying income for loan applications

-

Filing taxes accurately

-

Tracking overtime and bonuses

-

Resolving discrepancies in pay

B. Employers:

Employers have legal and practical reasons to provide pay stubs:

-

Compliance with labor laws

-

Maintaining accurate payroll records

-

Addressing employee inquiries about compensation

-

Simplifying tax reporting processes

C. Entrepreneurs:

Self-employed individuals and freelancers also benefit from creating pay stubs:

-

Demonstrating steady income for loans or rentals

-

Organizing finances for tax purposes

-

Presenting a professional image to clients

Here’s a comparison of pay stub needs across different groups:

| Group | Primary Uses | Frequency of Need | Legal Requirement |

|---|---|---|---|

| Employees | Income verification, tax filing | Every pay period | Yes (in most states) |

| Employers | Legal compliance, record-keeping | Every pay period | Yes |

| Entrepreneurs | Loan applications, financial organization | As needed | No, but beneficial |

Pay stubs are versatile financial documents that play a crucial role in various aspects of personal and business finance. Whether you’re an employee seeking to understand your earnings, an employer striving for compliance, or an entrepreneur managing your finances, pay stubs are indispensable tools in today’s financial landscape. Next, we’ll explore the legal aspects of providing pay stubs to employees.

Do I Have To Give Pay Stubs To My Employees?

Legal Requirements

In many states, employers are legally obligated to provide pay stubs to their employees. However, the specific requirements can vary:

-

Mandatory States: Some states require employers to provide pay stubs for every pay period.

-

Upon Request States: Other states only require pay stubs to be provided if an employee requests them.

-

No Requirement States: A few states have no laws mandating pay stub provision.

| State Type | Example States | Requirement |

|---|---|---|

| Mandatory | California, New York | Must provide for every pay period |

| Upon Request | Florida, Georgia | Must provide if employee asks |

| No Requirement | Alabama, Arkansas | No legal obligation |

Best Practices

Even if not legally required, providing pay stubs is considered a best practice for several reasons:

-

Transparency: Builds trust with employees

-

Record-keeping: Helps with tax filing and financial planning

-

Dispute resolution: Provides clear documentation of wages and deductions

-

Employee satisfaction: Demonstrates professionalism and respect

Electronic vs. Paper Pay Stubs

Modern businesses often opt for electronic pay stubs due to:

-

Cost-effectiveness

-

Environmental friendliness

-

Easy accessibility for employees

-

Simplified record-keeping

However, ensure that your electronic system complies with state laws regarding access and storage of pay information.

Now that we’ve covered the legal and practical aspects of providing pay stubs, let’s explore how employees can obtain their pay stubs if they don’t receive them automatically.

How Can An Employee Get A Pay Stub?

A. Direct deposit

Direct deposit is often the most convenient way for employees to receive their pay stubs. When an employer uses direct deposit, they typically provide electronic pay stubs that can be accessed through a secure online portal. This method offers several advantages:

-

Instant access to pay information

-

Environmentally friendly (paperless)

-

Reduced risk of lost or stolen pay stubs

| Advantages | Disadvantages |

|---|---|

| Immediate availability | Requires internet access |

| Secure storage | May require tech-savvy users |

| Easy to organize and track | Potential for system downtime |

B. Check stub maker

For employees who need to generate their own pay stubs, a check stub maker can be an invaluable tool. These software solutions allow users to input their pay information and create professional-looking pay stubs. Benefits include:

-

Customizable templates

-

Accurate calculations

-

On-demand stub creation

C. Previous employer

If an employee needs past pay stubs, contacting their previous employer is often a viable option. Most companies are required to keep payroll records for a certain period. When reaching out to a former employer:

-

Contact the HR department or payroll office

-

Provide necessary identification information

-

Specify the pay periods needed

-

Request electronic or physical copies

It’s important to note that while employers are generally obligated to provide this information, there may be a processing time or even a small fee involved. Employees should be prepared to verify their identity and may need to submit a formal request in writing.

Risks Of Having A Fake Paystub!

Risks Of Having A Fake Paystub!

The use of fake pay stubs can lead to severe consequences, both legal and financial. It’s crucial to understand the risks associated with using fraudulent pay stubs, especially when applying for loans, renting apartments, or during employment verification processes.

A. Not All Online Paystub Generator Software are Created Equal

When it comes to online pay stub generators, quality and legitimacy vary significantly. Here’s a comparison of reliable vs. unreliable pay stub generators:

| Feature | Reliable Generators | Unreliable Generators |

|---|---|---|

| Accuracy | High precision in calculations | May contain errors or inconsistencies |

| Legal Compliance | Adheres to local and federal regulations | May not comply with legal requirements |

| Customization | Offers tailored options for different industries | Limited or generic templates |

| Security | Implements robust data protection measures | May lack proper security protocols |

| Customer Support | Provides responsive assistance | Limited or no customer support |

Using an unreliable pay stub generator can lead to:

-

Legal troubles: Submitting inaccurate financial information is often considered fraud

-

Loan rejections: Banks and lenders can easily spot fake pay stubs

-

Employment issues: Employers may terminate contracts based on falsified documents

-

Damaged credit score: If caught using fake pay stubs for loans, your credit score could suffer

To avoid these risks, always choose a reputable pay stub generator that prioritizes accuracy and compliance. Remember, the consequences of using fake pay stubs far outweigh any perceived short-term benefits. Next, we’ll explore the key differences between real and fake pay stubs to help you identify legitimate documentation.

What Is The Difference Between Real And Fake Pay Stubs?

Real vs. Fake Pay Stubs: Key Differences

Identifying Features

| Real Pay Stubs | Fake Pay Stubs |

|---|---|

| Accurate company information | Inconsistent or missing details |

| Precise calculations | Rounded or incorrect figures |

| Professional formatting | Amateur design or layout errors |

| Consistent pay periods | Irregular or mismatched dates |

Real pay stubs are official documents issued by employers, while fake pay stubs are fabricated for various reasons, often illegally. Here are the main differences:

-

Information Accuracy:

-

Real: Contains accurate employer details, employee information, and tax withholdings

-

Fake: May have inconsistent or incorrect company information, employee details, or tax calculations

-

-

Calculation Precision:

-

Real: Exact figures for earnings, deductions, and taxes

-

Fake: Often rounded numbers or incorrect calculations

-

-

Formatting and Design:

-

Real: Professional layout with consistent fonts and formatting

-

Fake: May have design inconsistencies or use generic templates

-

-

Verification:

-

Real: Can be easily verified with the employer

-

Fake: Difficult or impossible to verify

-

-

Legal Compliance:

-

Real: Adheres to state and federal regulations

-

Fake: May not include required legal information or disclaimers

-

Understanding these differences is crucial for employers, employees, and financial institutions to prevent fraud and ensure compliance with labor laws.

Do I Need A Paystub Generator?

Do I Need A Paystub Generator?

If you’re wondering whether you need a paystub generator, consider these key indicators:

A. Disorganized payroll system

A disorganized payroll system can lead to numerous issues:

-

Delayed payments

-

Inaccurate calculations

-

Compliance risks

-

Time-consuming manual processes

Using a paystub generator can help streamline your payroll process, ensuring accuracy and efficiency.

B. Unsatisfied Employees

Employee satisfaction is crucial for any business. Here’s how a paystub generator can help:

| Without Paystub Generator | With Paystub Generator |

|---|---|

| Unclear payment breakdowns | Detailed, easy-to-understand pay information |

| Difficulty tracking overtime | Clear overtime calculations |

| Inconsistent pay records | Standardized, professional pay stubs |

Providing clear, professional paystubs can significantly improve employee satisfaction and trust.

C. Staff shortage

If you’re operating with limited staff, a paystub generator can be invaluable:

-

Automates time-consuming payroll tasks

-

Reduces the need for dedicated payroll personnel

-

Minimizes errors associated with manual calculations

-

Allows you to focus on core business activities

By addressing these issues with a paystub generator, you can improve your payroll process, boost employee satisfaction, and operate more efficiently even with limited staff. Next, we’ll explore the various uses of pay stubs and how they can benefit both employers and employees.

What Are Pay Stubs Useful For?

![]() A. Paystub for Loan Application

A. Paystub for Loan Application

Pay stubs play a crucial role in the loan application process. Lenders use them to verify an applicant’s income and employment status, which are key factors in determining creditworthiness. Here’s how pay stubs contribute to loan applications:

-

Proof of steady income

-

Verification of employment

-

Calculation of debt-to-income ratio

| Loan Type | Typical Pay Stub Requirements |

|---|---|

| Personal Loans | 2-3 most recent pay stubs |

| Mortgage Loans | 30 days of pay stubs |

| Auto Loans | 1-2 most recent pay stubs |

B. Paystub for Large Purchases

When making significant purchases, such as buying a car or expensive electronics, pay stubs can serve as proof of income. This is particularly useful when:

-

Applying for financing options

-

Negotiating better terms

-

Demonstrating financial stability

C. Paystub for Renting an Apartment

Landlords often require pay stubs to ensure potential tenants can afford the rent. Pay stubs are valuable for:

-

Proving consistent income

-

Meeting income requirements (usually 2-3 times the monthly rent)

-

Demonstrating employment stability

D. Paystub for Compensation and Claims

In cases of workplace injuries or disputes, pay stubs can be essential for:

-

Calculating workers’ compensation benefits

-

Supporting unemployment claims

-

Verifying lost wages in legal proceedings

E. Paystub for Tax Filing

During tax season, pay stubs become invaluable tools for accurate filing:

-

Reconciling income with W-2 forms

-

Tracking deductions and withholdings

-

Estimating quarterly tax payments for self-employed individuals

Pay stubs are versatile documents that serve multiple purposes in various financial and legal scenarios. Their importance extends beyond simple proof of income, making them essential for many aspects of personal and professional life.

Payroll Deductions Explained On An Employee Pay Stub

Types of Payroll Deductions

Payroll deductions are an essential part of an employee’s pay stub, reflecting various withholdings from their gross pay. Understanding these deductions is crucial for both employers and employees. Let’s explore the main types of payroll deductions:

-

Mandatory Deductions:

-

Federal Income Tax

-

State Income Tax (where applicable)

-

Social Security Tax

-

Medicare Tax

-

-

Voluntary Deductions:

-

Health Insurance Premiums

-

Retirement Plan Contributions (e.g., 401(k))

-

Life Insurance Premiums

-

Charitable Contributions

-

How Deductions Affect Net Pay

The relationship between deductions and net pay is straightforward: the more deductions, the lower the net pay. Here’s a simple breakdown:

| Calculation Step | Amount |

|---|---|

| Gross Pay | $3,000 |

| Total Deductions | $800 |

| Net Pay | $2,200 |

Understanding Tax Withholdings

Tax withholdings are complex and depend on various factors:

-

Filing status (single, married, head of household)

-

Number of dependents

-

Additional withholding requests

Employees can adjust their withholdings by submitting a new W-4 form to their employer. It’s important to review withholdings periodically to ensure accuracy and avoid surprises during tax season.

Now that we’ve covered payroll deductions, let’s explore how paystubs can be used as proof of income.

Can Paystubs Be Used As Proof Of Income?

Can Paystubs Be Used As Proof Of Income?

Pay stubs are indeed a widely accepted form of proof of income. They provide a detailed breakdown of an employee’s earnings, taxes, and deductions, making them a reliable source of financial information. Here’s why pay stubs are valuable as proof of income:

-

Accuracy: Pay stubs reflect precise financial details

-

Regularity: They are typically issued on a consistent basis

-

Official documentation: Pay stubs are generated by employers

-

Comprehensive information: They include various financial aspects

| Advantages | Disadvantages |

|---|---|

| Easily obtainable | May not reflect irregular income |

| Shows consistent income | Doesn’t show future earning potential |

| Includes tax information | Can be manipulated if not verified |

| Accepted by most institutions | Some may require additional documentation |

Company Data Security

When using pay stubs as proof of income, it’s crucial to consider the security of sensitive company and employee data. Here are some key points to keep in mind:

-

Redact unnecessary personal information before sharing

-

Use secure methods for transmitting pay stub data

-

Implement strict access controls for payroll systems

-

Regularly update security protocols to protect against data breaches

By prioritizing data security, companies can safely provide pay stubs as proof of income while safeguarding sensitive information. This approach ensures compliance with privacy regulations and maintains trust between employers and employees.

How Do Small & Medium Sized Businesses Manage The Payroll Of Employees?

Managing Payroll for Small & Medium Sized Businesses

Small and medium-sized businesses (SMBs) face unique challenges when it comes to managing employee payroll. Here are some effective strategies and tools they commonly use:

Payroll Software Solutions

Many SMBs opt for specialized payroll software to streamline their processes. Here’s a comparison of popular options:

| Software | Features | Pricing |

|---|---|---|

| QuickBooks Payroll | Tax calculations, direct deposit, mobile app | $45-125/month |

| Gusto | Full-service payroll, benefits administration | $39-149/month + $6-12/employee |

| ADP Run | Compliance support, HR tools | Custom pricing |

Outsourcing to Payroll Services

Some businesses choose to outsource their payroll management. Benefits include:

-

Reduced risk of errors

-

Time savings for business owners

-

Expert handling of tax compliance

In-house Payroll Management

For businesses with simpler payroll needs, in-house management using spreadsheets or basic accounting software can be sufficient. Key steps include:

-

Calculating hours worked

-

Determining gross pay

-

Calculating deductions

-

Processing payments

-

Maintaining accurate records

Regardless of the method chosen, accurate payroll management is crucial for employee satisfaction and legal compliance. As businesses grow, they often find that investing in more robust payroll solutions becomes necessary to handle increasing complexity and scale.

What Are The Benefits Of Using Electronic Pay Stubs For Your Business?

Cost-Effective and Eco-Friendly

Electronic pay stubs offer significant cost savings for businesses. By eliminating paper, printing, and postage expenses, companies can reduce their operational costs substantially. This digital approach also contributes to environmental conservation by reducing paper waste and carbon footprint.

Increased Efficiency and Accuracy

Digital pay stubs streamline the payroll process, saving time and minimizing errors. Automated calculations ensure accuracy, reducing the risk of manual mistakes that can lead to employee dissatisfaction or compliance issues.

| Traditional Pay Stubs | Electronic Pay Stubs |

|---|---|

| Time-consuming | Fast and efficient |

| Prone to errors | Highly accurate |

| Storage space required | Cloud-based storage |

| Limited accessibility | 24/7 accessibility |

Enhanced Security and Compliance

Electronic pay stubs offer improved security measures, protecting sensitive employee information from unauthorized access. They also help businesses maintain compliance with labor laws and regulations by providing easily accessible records.

Improved Employee Experience

Digital pay stubs provide employees with:

-

Instant access to their pay information

-

Historical pay data at their fingertips

-

Easy integration with personal finance tools

-

Reduced risk of lost or damaged paper stubs

Scalability and Flexibility

As your business grows, electronic pay stubs easily scale to accommodate an increasing number of employees without additional administrative burden. They also offer flexibility in customization and reporting, allowing businesses to adapt to changing needs.

Success Strategies For Your Business Using the Payroll Pay Stub

Streamline Payroll Processes

One of the most effective success strategies for your business using payroll pay stubs is to streamline your payroll processes. By utilizing a professional bank statement maker software, you can automate the creation of accurate and detailed pay stubs. This not only saves time but also reduces the likelihood of errors.

-

Automate pay stub generation

-

Reduce manual data entry

-

Increase accuracy and consistency

Enhance Financial Transparency

Implementing a robust pay stub system enhances financial transparency within your organization. This clarity can lead to improved trust between employers and employees, as well as better financial decision-making.

-

Provide detailed breakdowns of earnings and deductions

-

Offer historical pay information

-

Enable easier budget planning for employees

Improve Compliance and Record-Keeping

Using professional pay stub software can significantly improve your compliance with labor laws and simplify record-keeping processes.

| Benefit | Description |

|---|---|

| Legal Compliance | Ensure adherence to state and federal regulations |

| Audit Readiness | Maintain accurate records for potential audits |

| Dispute Resolution | Quickly address and resolve pay-related issues |

Leverage Data for Business Insights

Pay stubs contain valuable data that can be leveraged for business insights. By analyzing this information, you can make informed decisions about workforce management and financial planning.

-

Track overtime trends

-

Analyze labor costs across departments

-

Identify opportunities for cost optimization

Enhance Employee Satisfaction

Providing clear, detailed pay stubs can contribute to higher employee satisfaction. When employees understand their compensation, they’re more likely to feel valued and secure in their roles.

Professional bank statement maker software offers a comprehensive solution for businesses and individuals alike. From generating accurate pay stubs to managing payroll efficiently, these tools simplify financial documentation processes. They provide numerous benefits, including time savings, reduced errors, and improved compliance with legal requirements.

As businesses continue to evolve, embracing digital solutions like electronic pay stubs can significantly enhance operational efficiency. Whether you’re a small business owner or an employee seeking proof of income, utilizing a reliable pay stub generator can streamline your financial management. Remember, while these tools offer convenience, it’s crucial to use them responsibly and in compliance with applicable laws and regulations. By leveraging the right pay stub software, you can focus on growing your business while ensuring transparent and accurate financial records.

Q&A

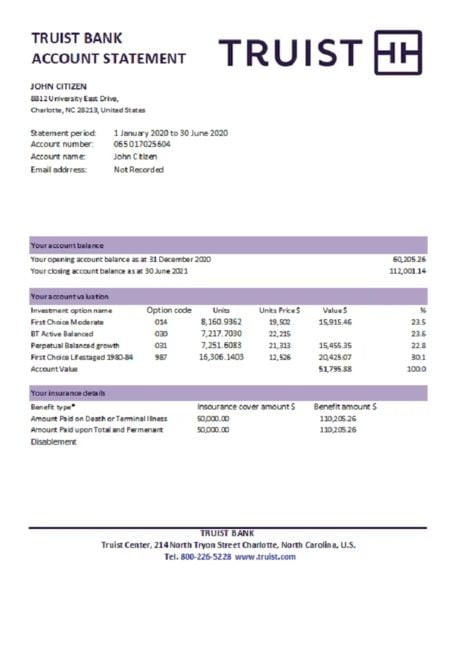

Q1: What is bank statement maker software, and how does it work?

A1: Bank statement maker software is a tool that generates bank statements based on user-inputted financial data. It works by allowing users to input their financial information, such as transactions, balances, and account details, and then generates a formatted bank statement.

Q2: What are the benefits of using bank statement maker software?

A2: The benefits of using bank statement maker software include:

1. Streamlined financial documentation

2. Time-saving

3. Accuracy and reduced errors

4. Customizable templates

5. Enhanced financial management

Q3: What features should I look for in a bank statement maker software?

A3: When selecting a bank statement maker software, look for features such as:

1. Customizable templates

2. Data import and export options

3. Transaction tracking and categorization

4. Balance calculation and reconciliation

5. User-friendly interface

Q4: Can bank statement maker software help with loan applications?

A4: Yes, bank statement maker software can help with loan applications by generating accurate and formatted bank statements that can be used to support loan applications.

Q5: Is bank statement maker software suitable for businesses and individuals?

A5: Yes, bank statement maker software can be used by both businesses and individuals to manage their financial documentation and streamline their financial management processes.

Q6: How do I choose the best bank statement maker software?

A6: To choose the best bank statement maker software, consider factors such as:

1. Features and functionality

2. User interface and ease of use

3. Customization options

4. Compatibility with your financial systems

5. Reviews and ratings from other users

These Q&A can help address common questions and concerns, providing valuable insights for individuals and businesses seeking to utilize bank statement maker software for financial management.

CONTACT TO ORDER