Need a bank statement and dread the idea of visiting your bank for some reason?

You’re not alone in this digital age.

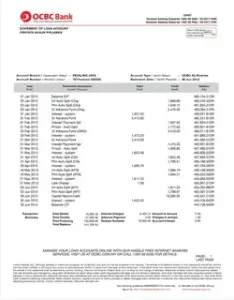

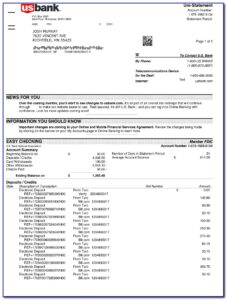

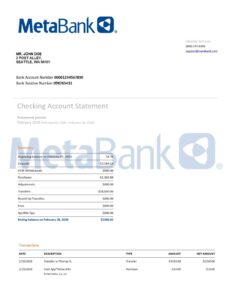

This post promises a quick fix to access your customized bank statements online

From setup to download, which represents the required amount you need.

Get ready to create your financial proof of income easily now.

Bank statements are essential financial documents that provide a detailed record of your account activity. They’re crucial for budgeting, tax preparation, and financial planning. With the advent of digital banking, accessing these statements has become more convenient than ever. This blog post will guide you through the process of obtaining your bank statement online, ensuring you can access this important information whenever you need it.

Preparing to Access Online

Before you begin, it’s important to ensure you have everything you need for a smooth online banking experience.

Checking internet connection

A stable internet connection is crucial for accessing this bank’s website securely. Make sure you’re connected to a reliable network, preferably a private one, to protect your sensitive information.

Necessary devices (PC or mobile)

You can access these bank statements from various devices. While a computer might offer a larger screen for easier viewing, many banks have user-friendly mobile apps that work just as well on smartphones or tablets.

Identifying Your Bank’s Website

Finding the correct website is the first step in accessing your online bank statement.

Find the official bank website

Use a search engine to find your bank’s official website. Usually, the official site will be one of the top results. Look for URLs that end in “.com” or “.bank” for added security.

Avoiding fake sites

Be cautious of phishing websites that mimic your bank’s site. Always double-check the URL and look for security indicators like a padlock icon in the address bar.

Creating an Online Account

If you haven’t already set up online banking, you’ll need to create an account.

Registering for online banking

Most banks offer an option to register for online banking directly from their homepage. Look for buttons labeled “Enroll” or “Sign Up for Online Banking.”

Required information for setup

You’ll typically need your account number, Social Security number, and other personal information to verify your identity. Have these details ready before you begin the registration process.

Navigating the Bank Website

Once you’ve created your account, it’s time to explore the online banking interface.

Logging into your account

Enter your username and password on the bank’s login page. Some banks may require additional security measures, such as answering security questions or entering a code sent to your phone.

User interface tips

Take some time to familiarize yourself with the layout of your bank’s website. Look for a menu or dashboard that lists different account options and features.

Accessing Your Statement

Now that you’re logged in, you can print out your bank statements.

Locating statement section

Look for tabs or links labeled “Statements,” “Documents,” or “Account Activity.” These are common locations for banks to store your statements.

Selecting the correct date range

Most banks allow you to view statements from different time periods. Select the month or date range for the statement you need.

Downloading Your Statement

Once you’ve found the right statement, it’s time to save it to your device.

PDF and other formats

Bank statements are typically available in PDF format, which preserves the document’s formatting. Some banks may offer additional formats like CSV for easier data analysis.

Saving and printing options

Look for download or print icons near your statement. Saving a digital copy ensures you always have access to it, while printing provides a physical backup.

Security Measures

Protecting your financial information is crucial when banking online.

Protecting your login details

Use a strong, unique password for your online banking account. Consider using a password manager to keep track of complex passwords securely.

Secure internet practices

Always log out of your banking session when you’re finished, especially on shared or public computers. Avoid accessing your bank account on public Wi-Fi networks.

Troubleshooting Common Issues

Even with a user-friendly interface, you might encounter some challenges.

Login problems

If you’re having trouble logging in, check that you’re entering the correct username and password. Most banks offer a “Forgot Password” option if you need to reset it.

Not finding statements

If you can’t locate your statements, check your account settings to ensure you’re enrolled in online statements. Some banks may require you to opt-in for this feature.

Conclusion

Accessing your bank statements online is a simple process that offers convenience and security. By following these steps, you can easily retrieve your financial information whenever you need it. Embrace these digital tools to stay on top of your finances and make informed financial decisions.

If you need help on how to get a customized bank statement online for any application purpose, CLICK HERE

Scot Bowman