Ever felt lost about what paperwork is needed for a loan? You’re in good company. Here, I’ll unveil the mysteries of the loan documentation process. Discover the key documents you absolutely must have. I promise, it’s simpler than it sounds and I’ll show you how!

So, you’re thinking about getting a loan? That’s great! But before you dive in, let’s talk about something super important: the documents you’ll need. Getting a loan can feel like a bit of a maze, but having the right papers in hand can make it so much easier. It’s like having a map to guide you through. In this post, we’re going to chat about the five key documents that lenders usually ask for. Trust me, being prepared with these can save you a lot of headaches!

Proof of Identity

First things first, lenders need to know who you are. It’s like when you meet someone new – you introduce yourself, right? Well, that’s what your ID does for you in the loan process.

Types of Acceptable IDs

- Driver’s license

- Passport

- State-issued ID card

- Military ID

Remember, these need to be current and valid. An expired ID is like trying to use an old bus pass – it just won’t work!

Pro tip: Always check the expiration date on your ID before you start the loan process. You don’t want to be caught off guard!

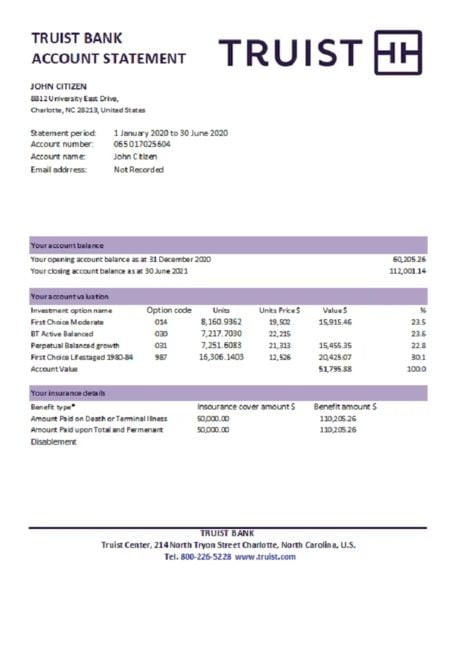

Proof of Income

Now, let’s talk money. Lenders want to know you can pay back the loan. It’s kind of like when you borrow money from a friend – they want to know you’ll be able to pay them back, right?

Documents Accepted for Income Verification

- Pay stubs (usually for the last few months)

- Tax returns

- W-2 forms

- Bank statements

- If you’re self-employed, you might need to show profit and loss statements

These documents show lenders that you have a steady income. It’s like showing them your piggy bank is always being filled up!

Proof of Residence

Next up, where do you live? Lenders want to know this too. It’s not because they’re nosy, I promise!

Types of Documents Needed

- Utility bills (electricity, water, gas)

- Lease agreement

- Mortgage statement

- Property tax bill

Why do they need this? Well, it helps them verify your address and shows stability. It’s like telling them, “Hey, I’m not just floating around. I’ve got roots!”

Credit History

Now, this is a big one. Your credit history is like your financial report card. It shows how well you’ve handled money in the past.

Importance of Credit Report and Score

Your credit report shows all your past and current debts, and how well you’ve been paying them. The credit score is like a summary of all that info in one number.

How to Get Your Credit Report

You can get a free credit report once a year from each of the three major credit bureaus. It’s like a financial check-up, and it’s totally free!

Remember: Checking your own credit doesn’t hurt your score. It’s like looking at your reflection in a mirror – look as much as you want!

Property Documents

If you’re getting a mortgage or using property as collateral, you’ll need some extra papers.

Necessary Property Documents

- Property deed

- Recent property appraisal

- Proof of homeowners insurance

- Title insurance

These documents are like a safety blanket for the lender. They want to know all about the property they might end up owning if things don’t work out.

Conclusion

So there you have it! These five key documents – proof of identity, income, residence, credit history, and property info – are your golden ticket to a smoother loan approval process. Having these ready is like showing up to a potluck with the perfect dish – it makes everything go so much better!

Remember, being prepared can make a world of difference. So gather these documents, take a deep breath, and you’ll be ready to tackle that loan application with confidence. You’ve got this!