Staring at your bank statement with more questions than answers? We’ve all been there. I’ll show you how easy it is to navigate through each section. Using straightforward examples, learn to track your finances like a pro. Stay tuned as we unveil tips and tricks of reading and understanding bank statement essentials.

Bank statements play a crucial role in personal and business finance management. They provide a detailed record of all transactions, helping individuals and organizations track their financial activities. This blog post will guide you through the process of creating a bank statement example, ensuring accuracy and practicality.

Understanding Bank Statements

Definition of a bank statement

A bank statement is a document issued by a financial institution that summarizes all transactions in an account over a specific period, typically monthly. It serves as an official record of your financial activity.

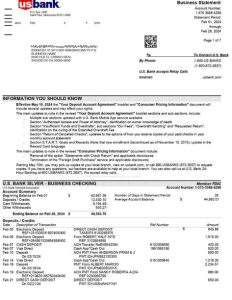

Key components of a bank statement

- Account holder’s information

- Account number

- Statement period

- Opening and closing balances

- Detailed list of transactions

- Fees and charges

- Interest earned or paid

Preparation for Creating a Bank Statement Example

Gather necessary information

Before creating a bank statement example, collect the following:

- Account holder’s details

- Account number

- Statement period dates

- List of transactions

- Opening balance

Tools and software needed

- Spreadsheet software (e.g., Microsoft Excel, Google Sheets)

- Word processing software

- Calculator (optional)

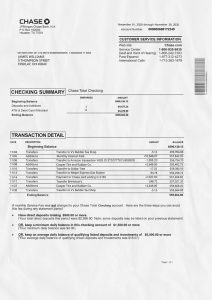

Step-by-Step Guide to Creating a Bank Statement

Step 1: Setting up the template

- Open your spreadsheet software

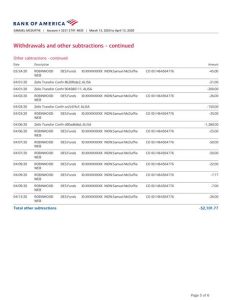

- Create columns for date, description, withdrawals, deposits, and balance

- Format cells appropriately (date format, currency format)

Step 2: Inputting transactions

- Start with the opening balance

- Enter each transaction chronologically

- Use formulas to calculate running balance

Step 3: Adding personal information

- Insert account holder’s name, address, and account number

- Add bank name and logo (if applicable)

- Include statement period dates

Step 4: Calculating the totals

- Sum up all withdrawals

- Sum up all deposits

- Calculate the closing balance

Step 5: Final review and validation

- Check all entries for accuracy

- Ensure the closing balance matches your calculations

- Review formatting and layout

Tips for Ensuring Accuracy

Double-checking figures

- Use a calculator to verify totals

- Cross-reference with actual bank statements if available

- Have someone else review your work

Common mistakes to avoid

- Transposition errors in numbers

- Forgetting to include all fees or charges

- Miscalculating interest

Using Bank Statement Examples Effectively

Educational purposes

Bank statement examples can be valuable tools for:

- Teaching financial literacy

- Demonstrating budgeting techniques

- Explaining banking concepts to students or clients

Business and professional use

Professionals can use bank statement examples for:

- Training new accounting staff

- Creating financial models

- Preparing for audits or financial reviews

Conclusion

Creating a bank statement example is a straightforward process when approached systematically. By following these steps and paying attention to detail, you can produce accurate and useful bank statement examples for various purposes. Remember to use these examples responsibly and ethically, especially when they involve sensitive financial information.