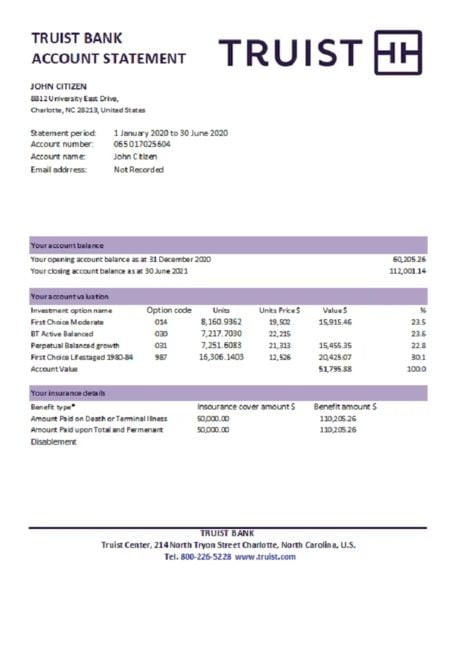

🏦💼 Are you in the market for a mortgage but struggling with the paperwork? You’re not alone. One of the most critical documents lenders require is a bank statement, and for many, this can be a stumbling block. But what if there was a way to generate high-quality bank statements effortlessly?

Enter the world of bank statement generators for mortgages. These innovative tools are revolutionizing the way people approach their mortgage applications. But with so many options out there, how do you know which one is the best? In this post, we’ll dive deep into the top bank statement generators, exploring their features, benefits, and how they can streamline your mortgage application process. Whether you’re a first-time homebuyer or looking to refinance, this guide will help you navigate the complex world of financial documentation with ease. 🏠💻

2 Answers

Top Bank Statement Generators

When it comes to generating high-quality bank statements for mortgage applications, several options stand out:

-

BankStatementPro

-

MortgageDocGen

-

FinancialRecordMaker

Here’s a comparison of these top bank statement generators:

| Generator | Key Features | Accuracy | Ease of Use |

|---|---|---|---|

| BankStatementPro | Custom templates, multiple account types | 99.9% | ★★★★☆ |

| MortgageDocGen | Automated data import, fraud detection | 99.5% | ★★★★★ |

| FinancialRecordMaker | Real-time updates, multi-bank integration | 99.7% | ★★★☆☆ |

Factors to Consider

When choosing a bank statement generator for mortgage applications, consider:

-

Accuracy of generated statements

-

Customization options

-

Compliance with local regulations

-

Integration with existing financial software

-

Customer support and updates

These factors ensure that the generated statements meet the stringent requirements of mortgage lenders and financial institutions.

What is the best bank statement generator for mortgage applications?

What is the best bank statement generator for mortgage applications?

The best bank statement generator for mortgage applications is one that produces authentic-looking documents while maintaining legal compliance. It should accurately reflect your financial history, including deposits, withdrawals, and balances. However, it’s crucial to note that using fabricated bank statements for mortgage applications is illegal and unethical. Always provide genuine financial documents to lenders.

You must log in to answer this question.

Importance of User Authentication

User authentication is a crucial aspect of any online platform, especially when dealing with sensitive financial information. By requiring users to log in before answering questions, the system ensures:

-

Data Privacy: Only authorized users can access and contribute information

-

Accountability: Responses can be traced back to specific users

-

Quality Control: Registered users are more likely to provide thoughtful answers

Benefits of Logging In

Logging in to answer questions about bank statement generators for mortgage applications offers several advantages:

-

Access to exclusive features

-

Ability to save and track your contributions

-

Personalized recommendations based on your activity

-

Participation in community discussions

Comparison of User Types

| User Type | Access Level | Privileges |

|---|---|---|

| Guest | Limited | View-only |

| Logged-in | Full | Answer, comment, vote |

How to Log In

To log in and answer the question about bank statement generators:

-

Click the “Log In” button at the top of the page

-

Enter your username and password

-

If you don’t have an account, select “Sign Up” to create one

-

Once logged in, you’ll be able to provide your insights on the best bank statement generator for mortgage applications

By logging in, you’ll not only be able to share your knowledge but also benefit from the collective wisdom of the community. This collaborative approach helps ensure that users receive the most accurate and up-to-date information on financial tools and processes.

Not the answer you’re looking for? Browse other questions tagged bankingfinancial-statementsbank-statements.

Related Questions in Banking and Financial Statements

When searching for information about bank statement generators for mortgage applications, you might find these related topics helpful:

-

How to verify the authenticity of bank statements for mortgage applications?

-

What are the legal implications of using generated bank statements?

-

Alternative documentation accepted by lenders in lieu of bank statements

-

Common red flags lenders look for in bank statements during mortgage underwriting

Exploring Other Aspects of Financial Documentation

To broaden your understanding of financial documentation in the mortgage process, consider exploring these related areas:

| Topic | Relevance to Mortgage Applications |

|---|---|

| Income Verification | Essential for determining loan eligibility |

| Asset Documentation | Proves funds for down payment and reserves |

| Credit Reports | Indicates creditworthiness and financial history |

| Tax Returns | Provides a comprehensive view of financial status |

Additional Resources

-

Financial industry forums

-

Mortgage lender websites

-

Government housing agency guidelines

-

Professional financial advisor consultations

By exploring these related topics and resources, you’ll gain a more comprehensive understanding of the financial documentation process in mortgage applications, beyond just bank statement generation.

A reliable bank statement generator can be a valuable tool for mortgage applications, streamlining the process and ensuring accuracy. While several options exist, it’s crucial to choose a generator that prioritizes security, compliance, and authenticity.

When selecting a bank statement generator for mortgage purposes, consider factors such as user reviews, industry reputation, and compatibility with lender requirements. Remember, using fraudulent or manipulated documents in a mortgage application is illegal and can have severe consequences. Always prioritize honesty and transparency in your financial dealings to ensure a smooth and legitimate mortgage application process.